In broadcast ad pricing, many organizations still use the same recipe to set rate cards. Media companies rely on intuition or guesses without the power and insights of data to price. In some cases, your “rate experts” spend hours in spreadsheet cells to optimize rates. Data may be in play here, but it’s not a sustainable process.

So, what’s the alternative to help you set rate cards more effectively? The perfect revenue cocktail, with a shake or a stir, is such because of data. In this opportunity, you can execute dynamic pricing and have access to rate cards directly in your sales growth platform.

Linear Pricing Is Full of Icy Barriers

The “iced” barriers to your ideal revenue cocktail impact your productivity and maximization. They can include:

- Balancing fixed rate cards for contracted revenue with “floating” ones for other inventory to meet budget

- Remaining competitive in pricing while optimizing revenue

- Overselling and underselling

- Conventional pricing activities that are manual and cumbersome

Each of these challenges keeps your station from driving more revenue.

How Often Do You Update Rate Cards?

That question could have a thousand different answers. There’s no industry standard, but weekly updates are the most common. A lack of automation makes these updates time intensive. Additionally, a lot can happen during a week that impacts demand. You’ll always be lagging behind the data in this approach.

Some stations change rates sporadically or only on an annual basis. In such a scenario, you are most likely leaving an abundance of money on the table.

Optimizing Rate Cards with Dynamic Pricing

You can grow revenue for your company without adding more inventory using dynamic pricing. Dynamic pricing, or yield management, is a variable pricing strategy that accounts for the demand of the product to price it optimally. Lots of businesses use it to their benefit, including airlines, hotels and retail.

Dynamic Pricing Data Ingredients

To create that perfect mix for your rates, you’ll need a dynamic pricing tool that accounts for:

- The demand for the media, spot, program, etc.

- Audience ratings

- Competitive landscape

Dynamic pricing starts with data from your traffic or reporting system. It requires historical data and looking forward on demand for proper analysis.

Static Rate Card vs. Dynamic Pricing

Data is one of the most potent components of decision-making. Its role in pricing your rate cards is instrumental to earning more top-line revenue.

Here’s the difference.

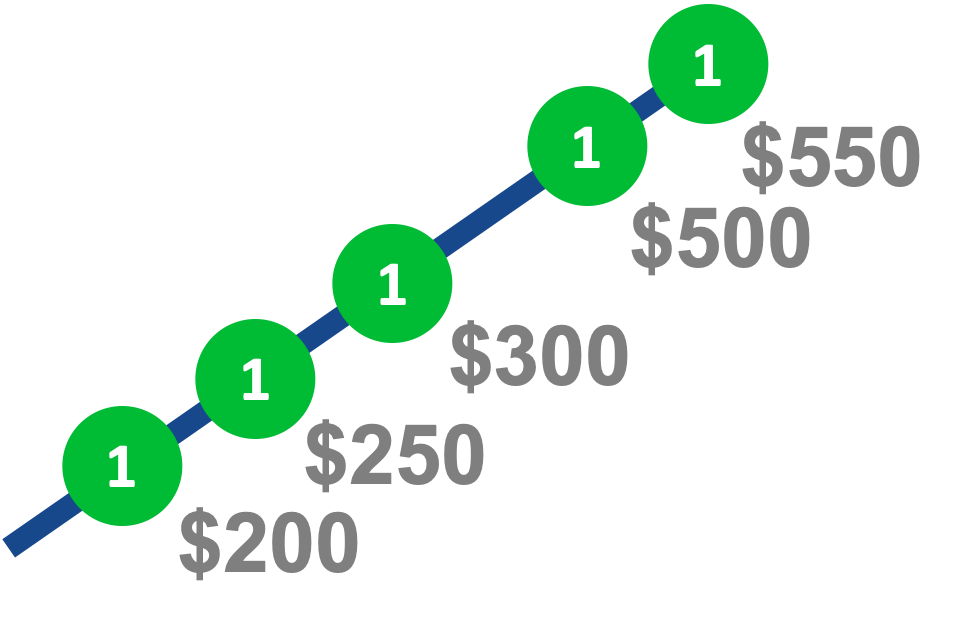

Static Rate Card

$500 per daypart

Three spots sold out of five

![]()

Revenue: $1,500

Dynamic Pricing

Rates vary depending on demand, and you have the ability to set floors and ceilings.

Five spots sold at $200, $250, $300, $500, $550 (Some are below your previous flat rate, and others are above it. And you sold all spots!)

Revenue: $1,800

This example shows that you don’t have to create new inventory or hire more sellers to increase revenue. Industry experts suggest that this model can boost it by 5-10%.

Rate Curves Move with Demand

Within a yield management platform, you have many choices for rate curves. Rate curves are just algorithms that do the work for you. Your curves can have floors and ceilings, and they can change for every 30-minute time block.

Rate curve examples:

Use even rates for high-demand spots that coincide with special programming.

Drop rate curves significantly as the time to air decreases.

Run a flat rate with specific curves for low-demand programming.

The flexibility of this allows you to test different curves to determine the models that work best.

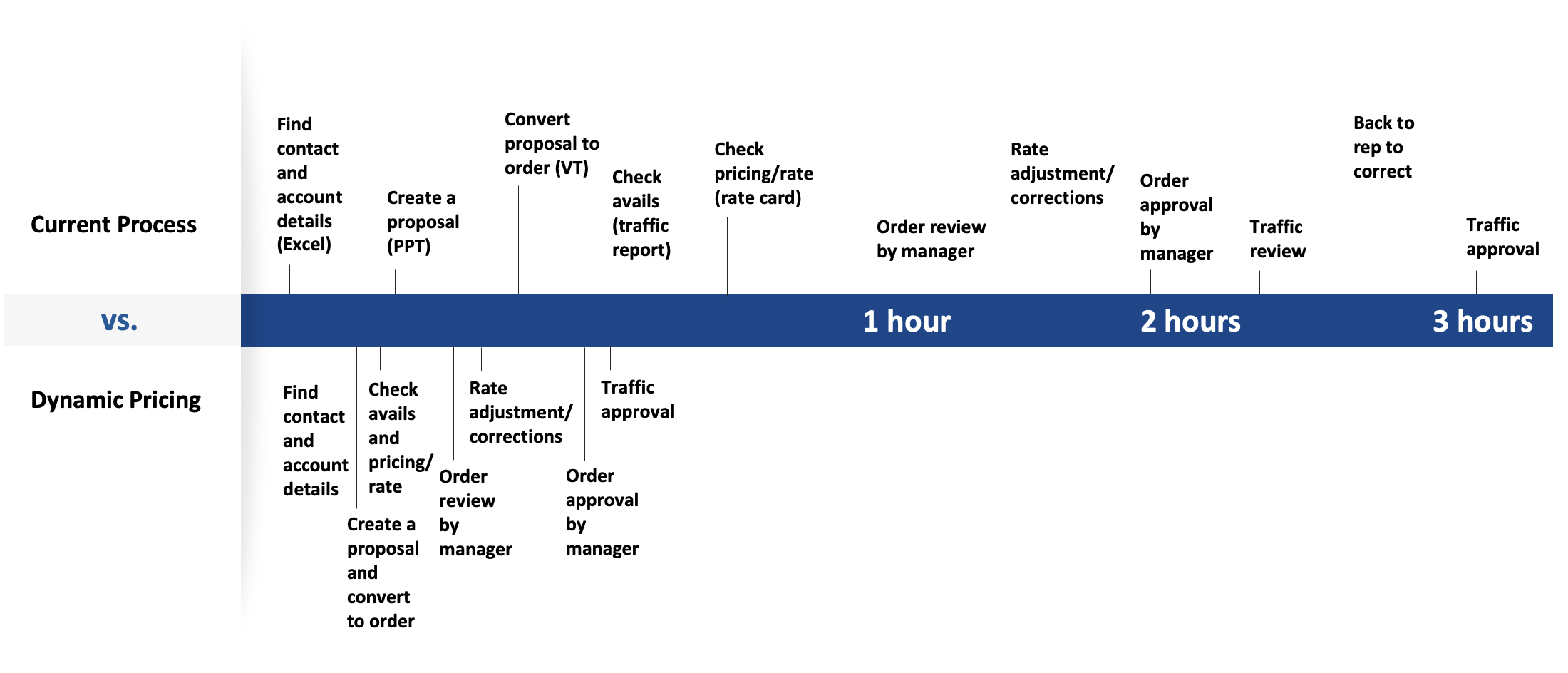

Having Avails and Pricing Accessible to Salespeople Is a Reason to Say Cheers

Salespeople creating proposals that require looking up avails in traffic and getting pricing from spreadsheets isn’t efficient. Your sales team spends too much time moving around systems and deciphering the traffic platform. They’re salespeople, not traffic managers, after all.

This process can create hours and hours of work!

With yield management, your salespeople reduce a three-hour ordeal to only 15 minutes. That equates to saving salespeople 70+ hours a week. Streamlining and simplifying the sales process means your team can get back to selling. Everyone can agree that this approach is worthwhile and advantageous.

Reimagining Linear Spot Advertising with Dynamic Pricing

If you want to optimize rate cards to create a steady flow of new income, you’ll need to mix in dynamic pricing. It’s easy and automated with Marketron REV. In addition to the yield management tool, it offers a central platform for proposal and order management. Its reporting capabilities also enable pipeline visibility, performance monitoring and other sales-focused analysis.