In comments filed with the FCC (Federal Communications Commission), the NAB (National Association of Broadcasters) requested a loosening of ownership caps for radio. Why? They expect radio ad revenue to decrease in 2022.

In comments filed with the FCC (Federal Communications Commission), the NAB (National Association of Broadcasters) requested a loosening of ownership caps for radio. Why? They expect radio ad revenue to decrease in 2022.

The NAB cited data that local stations’ OTA (over-the-air) revenues fell by 44.9% from 2005-2020. They also shared data from Nielsen on FM radio revenue declines, which fell by 42.9% during the same period. Further, Nielsen also reported that AQH (average quarter-hour) listening dropped by 23.5% in the last five years.

The NAB’s filing included several asks, which you can review in the link above. With or without the granting of these requests, what are actionable steps that stations can take now to close the gap in revenue?

Compensating for Decreasing Radio Ad Revenues

There are two specific ways to find opportunities to compensate for decreasing radio ad revenues.

Optimizing Inventory with Dynamic Pricing

The first approach is to generate more revenue from your airtime inventory. That requires a new approach to pricing that’s dynamic, meaning that rate cards change based on demand and historical data. This practice is called yield management. Airlines and hotels have been using it for years to maximize revenue, and broadcasters can, too.

According to experts in the field, it can increase profit by up to 8%. Moreover, you can boost revenue without increasing costs related to new programs, promotions, headcount or inventory.

What powers it is a sales engine that crunches the numbers for you with advanced algorithms. Nothing’s manual, and pricing isn’t by intuition. It’s data-driven, and that’s what allows you to sell the same inventory while improving top-line revenue.

While this approach can help you with your airtime dollars, there are more opportunities besides linear spots.

Expanding to Digital Advertising

Digital advertising is an excellent complement to radio spots. It offers your advertisers new channels to attract new customers. Many of your customers are likely engaging with digital in some way, but what if they could combine the two with only one company?

That means more revenue for you and greater convenience and results for them. So, why should your advertisers buy digital products from you? You have the advantage for many reasons.

You understand their business and have a proven record of delivering positive results for their airtime advertising.

Digital and radio perform best together. That’s because digital allows for targeting while radio offers exceptional reach. With an integrated advertising plan that uses both, your advertisers can experience improved results.

Bundling both mediums is cost-effective for your customers. You can incentivize their purchase of digital, and they don’t have to deal with add-on charges from digital agencies.

It’s more convenient for your advertisers to have one point of contact and one bill for ad spend.

Radio buyers are embracing digital. If they don’t, their competitors will. A study concluded that 47% of radio buyers plan to invest in new forms of marketing, with 66% likely to purchase a new type of digital marketing.

Further, digital ad spending is growing, not contracting. For 2021, the projection is $524.31 billion globally. In 2022, it rises to $645.8 billion.

If you want a piece of this pie, you have to be in the game. However, you may have concerns about how you’ll manage it and increase the digital advertising literacy of your sellers.

Cross-Channel Advertising Platforms Enable Scaling and Streamlining

The software to manage digital and airtime ads doesn’t have to be disparate. A cross-channel advertising platform combines them, allowing you to build proposals and enter orders for both. It also allows you to bill all services together and provide reporting to your advertisers on performance.

With an intuitive and easy-to-use solution, you’ll be able to kick off your digital advertising selling efforts with little friction and greater efficiency.

Training on Digital Selling Is Available

You may also have hesitation about selling digital because your salespeople aren’t experts on it. They are, however, experts on your local market and their clients’ needs. Providing them impactful sales enablement training develops these skills and gives them the confidence to pitch it to their advertisers.

The more they know, the better they’ll be at gaining new business. This type of training doesn’t have to be expensive. In fact, it’s something we provide for free for all our digital advertising clients.

Radio Is Still a Viable Advertising Medium

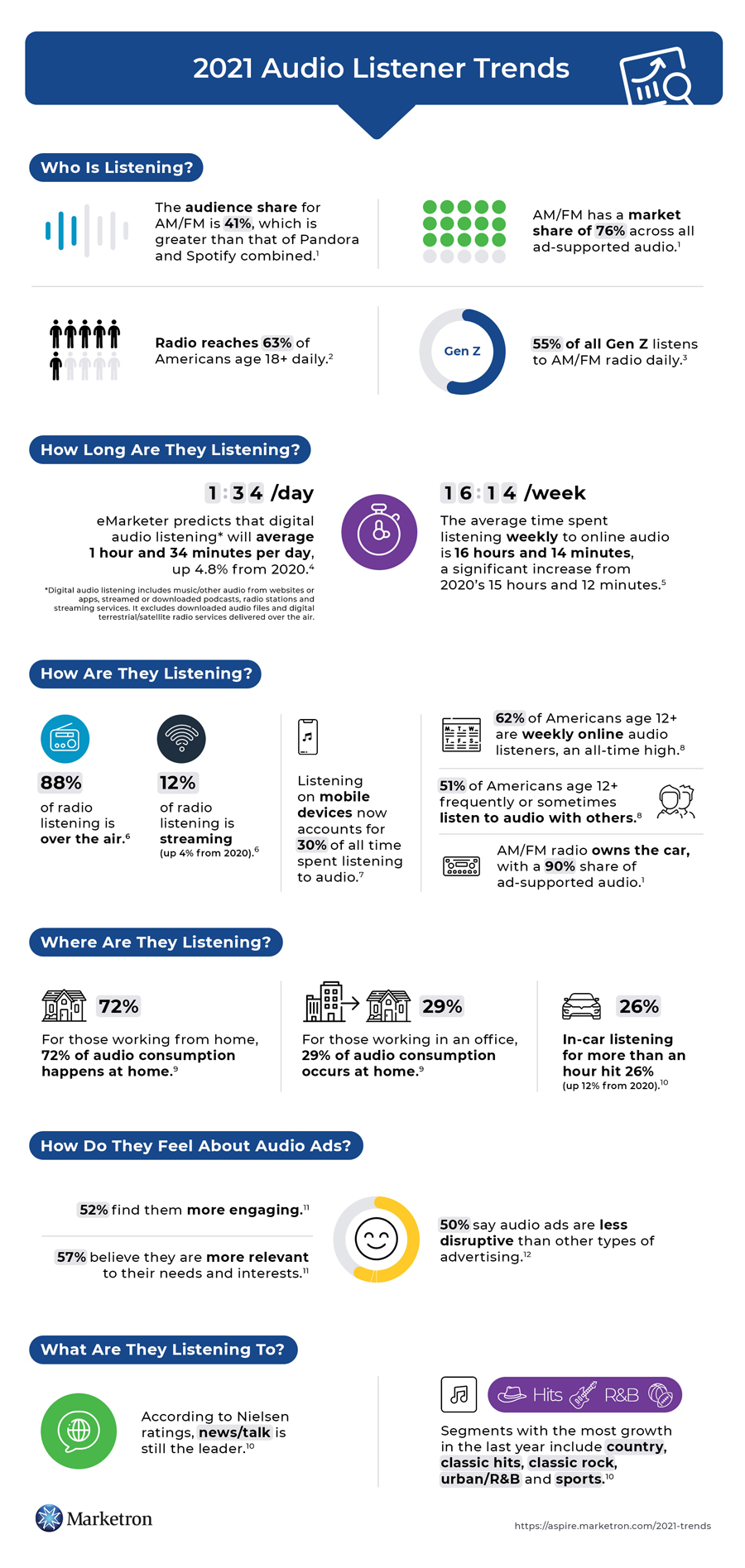

While digital can help you drive new revenue streams, don’t forget that radio is still a great avenue for advertising. In an analysis of audio listening trends, we found some insights that highlight optimism:

While digital can help you drive new revenue streams, don’t forget that radio is still a great avenue for advertising. In an analysis of audio listening trends, we found some insights that highlight optimism:

- Audience share for AM/FM is greater than that of Pandora and Spotify combined.

- 55% of Gen Z listens to AM/FM daily.

- 88% of radio listening is OTA.

- Some radio segments grew in the last year (country, classic hits, classic rock, urban/R&B and sports).

These data points and many more illustrate that radio still has exceptional reach across demographics. Further, our trend analysis found that consumers have more positive feelings about audio ads than other forms.

These are all points you can bring to the table when talking with your broadcast advertisers. Doing so could increase their spending or at least ensure you win the renewal. Most importantly, it also shows what a great complement linear and digital are.

Radio Ad Revenue Decreases Don’t Have to Impact Your Station

Looking at the future of radio ad revenue, no one can deny the facts. That doesn’t mean you can’t take action to close the gap. By leveraging dynamic pricing, you can optimize your radio inventory revenue. The next horizon for your growth is definitely digital.

To learn more about adding third-party digital to your portfolio options, check out these resources: